Five of the largest credit card issuers in the United States this week reported lower charge-off and delinquencies rates in their credit card portfolios for March.

The five large banks – Bank of America, Capital One, Citigroup, Discover, and JP Morgan Chase – account for the vast majority of credit card accounts in the U.S.

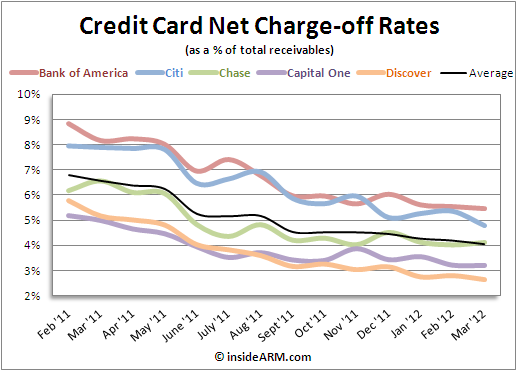

Only Chase reported an increase in their card chargeoff rate for March, and the increase was very small. The average net card charge-off rate among the banks dropped to 4.04 percent in March from 4.19 percent in February, and from 6.56 percent in March 2011. Net chargeoff rates take into account money remitted from external debt collection activities and debt portfolio sales.

Bank of America said its provision for credit losses declined to the lowest level since the third quarter of 2007.

The 4.04 percent average charge-off rate is already near long-term historical averages. Once Bank of America (with the highest charge-off rate of 5.48 percent) works its way through its backlog of defaulted accounts, the average net rate will be below historical averages.

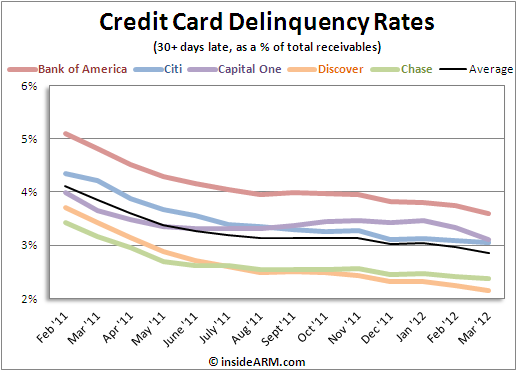

The average 30+ day delinquency rates among the major issuers also fell – from 2.97 percent in February to 2.85 percent in March. March’s rate is exactly one full percentage point lower than March 2011’s 3.85 percent rate. All issuers reported a decline in delinquencies.

The average delinquency rate is now considerably below long-term averages, a testament to the tighter lending standards for credit card accounts being employed by major banks since the credit crisis and subsequent recession and the passage of stricter regulations for card issuers.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)