For at least the past two years, we’ve been hearing about the rapid rise in student loan debt in the U.S. By most measures, outstanding student loan balances are surpassed by just one other debt type: mortgages. Americans owe more for attending college than for anything else, except buying a home.

Wait, what about auto loans? Nope. Even though cars are expensive and more Americans own a car than have attended college, student loan debt is higher.

Credit cards? At one point recently, yes, total credit card debt outstanding was higher. But the near-collapse of the financial system took care of that.

It’s student loans. At the end of the first quarter of 2014, total student loan debt outstanding in the U.S. stood at $1.11 trillion, according to the Federal Reserve Bank of New York in a report released Tuesday. How does that stack up against other types of debt?

Here’s a table from the Fed’s report that tracks changes in mortgages, student loans, auto loans, credit cards, and home equity lines of credit (HELOC) in Q1 2014 compared to the previous quarter and the previous year:

| Category | Total as of Q1 2014 | Change from Q4 2013 | Change from Q1 2013 |

| Mortgage Debt | $8.17 trillion | (+) $116 billion | (+) $233 billion |

| Student Loan Debt | $1.11 trillion | (+) $31 billion | (+) $125 billion |

| Auto Loan Debt | $875 billion | (+) $12 billion | (+) $81 billion |

| Credit Card Debt | $659 billion | (-) $24 billion | (-) $1 billion |

| HELOC | $526 billion | (-) $3 billion | (-) $26 billion |

| Total Debt | $11.65 trillion | (+) $129 billion | (+) $419 billion |

Student loan debt outstanding is significantly higher than auto loan debt. And over the past year, it grew by more.

But the really fascinating data lies deeper in the Fed’s report.

The Federal Reserve Bank of New York has been engaged in a very interesting research project for more than a decade. Using a nationally representative 5% random sample of all Americans with a Social Security number and a credit report, the FRBNY analyzes Equifax credit report data looking for tradelines placed on the reports by creditors, servicers, and debt collectors. They go a step further and sample all other people living at the same address as the primary sample members to get a true picture of household credit and debt. The result is a report that includes data from 40 million Americans each quarter.

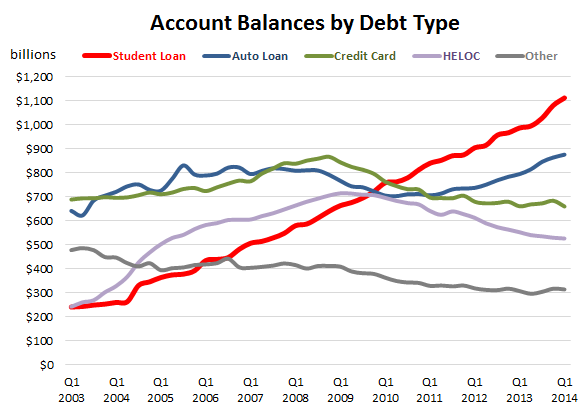

Examining the quarterly data back to the first quarter of 2003 reveals a trend in the growth of student loan debt that does not match any other type of debt. In fact, the growth in student loan debt over the past 11 years does not seem to be vulnerable to any of the economic forces that caused so much turbulence in the other markets.

That big, bright red line marching ever higher is outstanding student loan debt. That line looks unlike any of the other lines. Credit cards, auto loans, HELOCs, and “Other” debt types — comprised mostly of personal loans and retail store financing — all reacted to the financial upheaval of late 2008/early 2009. Student loans didn’t care. They continued a steady ascent.

(NOTE: Mortgages are not included in the graph because that would cause the graph to be VERY tall. The line for mortgages over the period, however, looks very similar to auto loans, just at a much higher level.)

It’s telling that in Q1 2003, outstanding balances on HELOCs and student loans were virtually identical. And for a few years, they had similar trajectories. That all changed in 2009 when HELOCs succumbed to economic forces, and student loans did not.

Here’s a table with the beginning and ending periods’ data, and the total change in balances over 11 years:

| Outstanding Balances (in $ billions) | |||

| Q1 2003 | Q1 2014 | Change | |

| Mortgages | $4,942 | $8,165 | 65% |

| Student Loans | $241 | $1,111 | 361% |

| Auto Loans | $641 | $875 | 37% |

| Credit Cards | $688 | $659 | -4% |

| HELOCs | $242 | $526 | 117% |

| Other | $478 | $314 | -34% |

| Totals | $7,232 | $11,650 | 61.1% |

The epic increase in student loan debt over the past 11 years has not been subject to economic forces. It has strictly been market-driven. The great debate now being waged in the U.S. is over how to best bring this market back into rationality.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)