The Consumer Financial Protection Bureau (CFPB) has been accepting debt collection complaints from consumers for about four months. Just last week, the regulator released some of the complaints data to the public. So how are collection agencies doing with their handling of the complaints?

Judging by the data provided so far, pretty well. The caveat here is with the data provided. The volume of debt collection complaints released by the CFPB is considerably lower than volumes previously reported, notably by the FTC’s Consumer Sentinel annual report.

As of Tuesday, there have been 5,625 debt collection complaints made public. These represent complaints received over four months; the totals from the FTC averaged nearly 15,000 per month. The issue here probably lies in what the CFPB actually released. The regulator said that the complaints represent only those that had responses from the companies named in the complaint. This means that any complaints against scam artists are not included. But it also means that complaints against legitimate collection agencies not yet registered with the CFPB are not included.

And there is some indication that registration is still an issue. In a recent survey on compliance technology sponsored by Columbia Ultimate and conducted by insideARM.com, 24 percent of respondents indicated they had not yet registered with the CFPB. And of that total, 42 percent said they had no intention of signing up.

ACA International Tuesday also made a push to get their collection agency members to register. The group said that during a presentation at last week’s Fall Forum & Expo, the head of the CFPB’s Stakeholder Support Group said many of the consumer complaints the CFPB considers “unresponded” are the result of agencies having not signed up for the complaint portal.

So those that aren’t already registered need to do so. Here’s the link: http://www.consumerfinance.gov/company-signup/

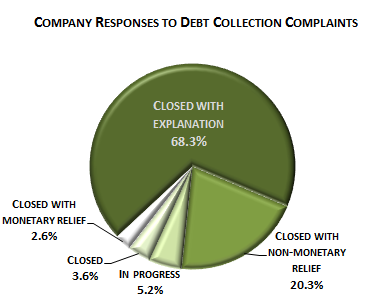

Of the debt collection complaints received, responded to, and released by the CFPB, collection agencies appear to be doing a good job resolving the issues. More than 68 percent of the complaints were ultimately Closed with Explanation. Another 20 percent were Closed with Non-Monetary Relief (like taking a consumer off a call list or removing a trade line). Only 2.6 percent of the complaints required monetary relief to satisfy the consumer.

Of the debt collection complaints received, responded to, and released by the CFPB, collection agencies appear to be doing a good job resolving the issues. More than 68 percent of the complaints were ultimately Closed with Explanation. Another 20 percent were Closed with Non-Monetary Relief (like taking a consumer off a call list or removing a trade line). Only 2.6 percent of the complaints required monetary relief to satisfy the consumer.

Consumers were largely satisfied with collection agency responses. Just 16.9 percent disputed the collector’s proposed remedy. Those complaints that were simply marked Closed had the highest dispute rate (20.4%), while those that were Closed with Explanation fared only a little better (18.9% dispute rate). Complaints that were closed with some type of relief had much lower dispute rates, with non-monetary relief being disputed only 10.4 percent of the time and monetary relief seeing an 11.6 percent dispute rate.

Don’t forget that insideARM.com is hosting a free webinar on the CFPB’s rulemaking process, an announcement made in conjunction with the complaints data release. Now is your chance to get involved. Register now.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)