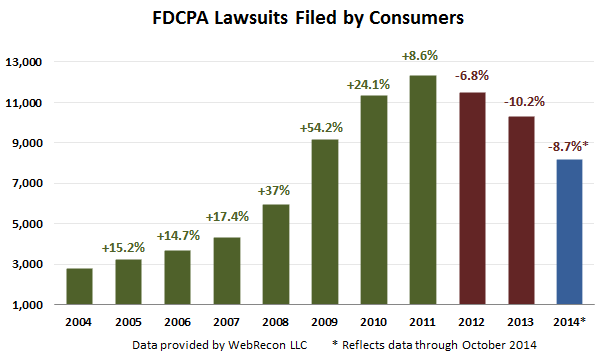

In October 2014, consumers filed 911 lawsuits claiming violations of the Fair Debt Collection Practices Act (FDCPA), up 13.4 percent from September and an increase of 16.1 percent from October 2013. But total FDCPA lawsuits are still on track to finish well below 2013 numbers, which would mark the third straight year of declines.

In data provided by WebRecon LLC, the total number of FDCPA lawsuits filed in 2014 stood at 8,146 at the end of October, 8.7 percent below the pace at the same time last year.

Ever since peaking at 12,330 lawsuits in 2011, FDCPA claims have steadily decreased year-over-year. This year looks to be the first since 2010 to see FDCPA lawsuits under 10,000.

WebRecon now also publishes information on class action suits for the major statutes covering debt collection. In October, 13.5 percent of FDCPA suits were class actions, up from 9.3 percent in September.

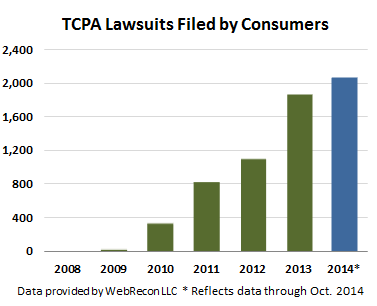

Consumer lawsuits claiming violations of the Telephone Consumer Protection Act (TCPA), meanwhile, decreased significantly in October. TCPA claims were down 22.6 percent, on a monthly basis, to 159. That number is still nearly four percent higher than in October 2013.

Of the TCPA suits filed in October 2014, 7.5 percent were class actions, up from 6.2 percent in September.

The year-over-year increase in TCPA suits is still holding its trend with two months left in 2014. Lawsuits claiming violations of the TCPA are up nearly 28 percent from the same time in 2013. There have already been more total TCPA suits filed in 2014 than for the full year 2013.

The year-over-year increase in TCPA suits is still holding its trend with two months left in 2014. Lawsuits claiming violations of the TCPA are up nearly 28 percent from the same time in 2013. There have already been more total TCPA suits filed in 2014 than for the full year 2013.

The TCPA lawsuit filing trend is the exact opposite of the trend seen in FDCPA suits. TCPA suit filings have exploded since 2010 with large gains each year. There are several possible reasons for this: a shifting legal environment involving TCPA cases leading to the type of ambiguity consumer attorneys love, a rise in the volume of attempts made to cell numbers driven by consumer habits, and a statute with higher possible payouts becoming the preferred target for consumers.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)