Lawsuits filed by consumers in U.S district court claiming violations of the Fair Debt Collection Practices Act (FDCPA) declined in August on both a monthly and yearly comparison basis. But debt collectors have found themselves increasingly in the crosshairs of suits claiming TCPA violations.

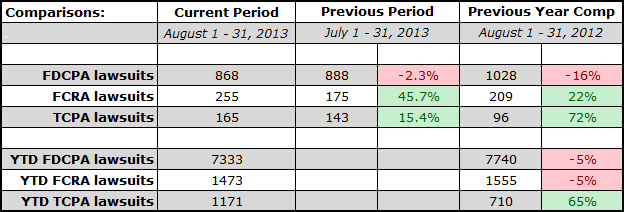

According to data provided by WebRecon LLC, FDCPA suits declined 2.3 percent in August compared to July, and fell 16 percent compared with August 2012. For the full year, FDCPA lawsuits are down 5 percent compared to the first eight months of 2012.

In 2012, FDCPA lawsuits fell nearly seven percent compared to 2011. It marked the first year that FDCPA suits against collectors declined after years of steady growth.

But the Telephone Consumer Protection Act (TCPA) has increasingly become a target for consumers and their attorneys for suits aimed at collection agencies. TCPA suits in August rose 15.4 percent from July and 72 percent compared to August 2012. Year-to-date, TCPA suits are up 65 percent.

Summary of August lawsuits:

- There were about 1,118 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 373, or (33.4%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 1,974 lawsuits since 2001

- Actions were filed in 152 different US District Court branches.

- About 981 different collection firms and creditors were sued.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)