A couple of weeks ago, our homepage poll asked this:

Pop Quiz! Can a collector tell a debtor that paying off a delinquent account will positively affect his credit score?

The question had been on our minds recently after publishing our Compliance Overview: FCRA – a primer for those looking for a better understanding of the intricacies of the Fair Credit Reporting Act.

Collection agencies can have an absolute influence on consumers’ credit scores. The information they provide to the Big Three CRAs (Credit Reporting Agencies) can either drive a score down or, in some cases, bump it up a couple of points.

Collection agencies can have an influence. But that doesn’t mean that they will. And that is the crux of our Pop Quiz.

Eleven of you… well, you missed the mark a little. One of the thing collectors have to be VERY careful about is functioning as an ad hoc credit counselor for the consumers they’re working with. You may feel like you’re helping a consumer by encouraging her to pay off her debts, and you may feel that detailing the alleged effects on her credit score will sweeten the deal. Instead, what you’re doing is: violating the FCRA.

Your best bet as a collector is: don’t give any advice at all to a consumer. Your job is to collect the debt, not promise better — or worse — credit scores.

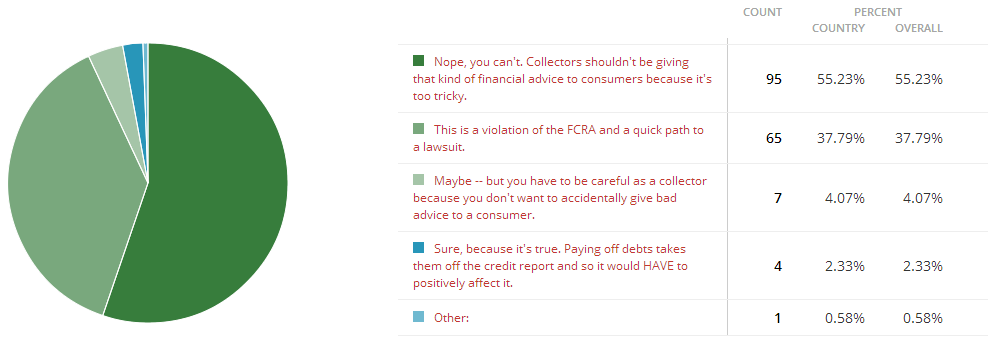

We included two answers that seem to be the same:

Nope, you can’t. Collectors shouldn’t be giving that kind of financial advice to consumers because it’s too tricky

and

This is a violation of the FCRA and a quick path to a lawsuit

More of you chose the first option than the correct second option, so at least the majority of you understand the risks involved. But the correct answer, as far as we can tell, is This is a violation of the FCRA. There is no safe way to counsel a consumer on her credit score as a collector. Best leave that to the other professionals.

You can buy insideARM.com’s primer to the FCRA here: Compliance Overview: Fair Credit Reporting Act

![Photo of Mike Bevel [Image by creator from ]](/media/images/15313207355886984574190085724020.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)