Debt buyer and diversified financial business services firm Portfolio Recovery Associates, Inc. (NASDAQ: PRAA) late yesterday reported financial results for the third quarter of 2013. The company said that it set records for revenue and net income.

In Q3 2013, Portfolio Recovery reported net income of $47.3 million, up 42 from the same period last year. Earnings per share were $0.93, compared with $0.65 a year ago, up 43 percent, adjusted for a 3:1 stock split effective August 1, 2013.

Revenues in the quarter were $197.8 million, up 31 percent from a year ago. Net finance receivables income increased 26 percent to $171.5 million and fee for service income increased 78 percent from a year ago to $26.3 million.

“In the third quarter, PRA continued the strong financial results of the first two quarters of 2013. Our employees again delivered record revenue and profitability for stockholders, as well as continued, significant investment in new portfolios of distressed debt,” said Steve Fredrickson, chairman, president and chief executive officer, PRA. “PRA’s renewed focus on our fee-for-service businesses also contributed to our third quarter profitability. Fee income from these businesses substantially increased to $26.3 million during the quarter, aided by a single, large Claims Compensation Bureau case, helping to drive PRA’s bottom-line results.”

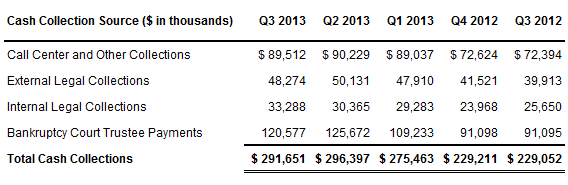

Total cash collections increased 27 percent over the year-ago period to $291.7 million, including bankruptcy court trustee payments of $120.6 million; $89.5 million in call center and other collections; and $81.6 million in legal collections.

The company said it invested $141.9 million in new portfolio purchases from U.S and U.K. creditors in the third quarter of 2013, compared with $103 million a year ago. Receivables purchased were acquired in 79 portfolios from 19 different sellers. Of the total for Q3, $100 million was in “core customer debt” with the remaining classified as bankruptcy court claims. Core customer debt purchased in the third quarter of 2013 included $89 million in U.S. accounts and $11 million in U.K. accounts.

The company has invested $756.4 million in portfolio purchases over the trailing twelve months.

Since the third quarter of 2012, Portfolio Recovery Associates has increased its debt collector headcount three percent to 2,054 and increased its total full-time equivalent employee count four percent to 3,223.

PRA also announced Wednesday that it is opening a new call center in the Dallas-Ft. Worth metroplex that will bring some 200 jobs to the area. PRA plans to immediately hire 150 operations managers, account representatives and other professional positions, with bilingual skills preferred, and an additional 50 employees by the end of 2014.

The facility, located in North Richland Hills, will have capacity for more than 550 employees. The move places all of the company’s U.S.-focused collection efforts in the United States.

According to Neal Stern, PRA’s EVP of Operations, major banks are moving toward prohibiting “offshore collections” as a condition of selling their accounts.

“Major banks are seeing growing value in companies that will manage these accounts with U.S.-based talent,” Stern said. “With the opening of the new call center, PRA is bringing all of its U.S. collections jobs back to the U.S.”

The company closed its small offshore offices earlier this year.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)