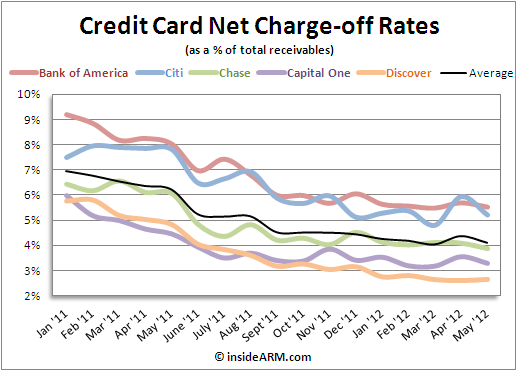

Four of the five largest credit card issuers in the U.S. last week reported declines for May in their net charge off rates in their securitized card portfolios, according to filings with the SEC.

Bank of America, Capital One, Chase, and Citi saw their net credit losses drop in May. Most reported significant increases in charge-offs in April as debt hangover from the holidays collided with persistent weakness in the labor market and the beginning of a new quarter for the banks.

The average net charge-off rate among the five issuers fell to 4.11 percent in May from 4.37 percent in April. Bank of America reported the highest loss rate at 5.52 percent. Only Discover reported an increase in the month, from 2.6 percent in April to 2.65 percent in May, the lowest rate among the five.

The credit losses, or chargeoff rates, are reported as net of recoveries and collections from the issuers’ gross charge-off rates of accounts securitized for investment.

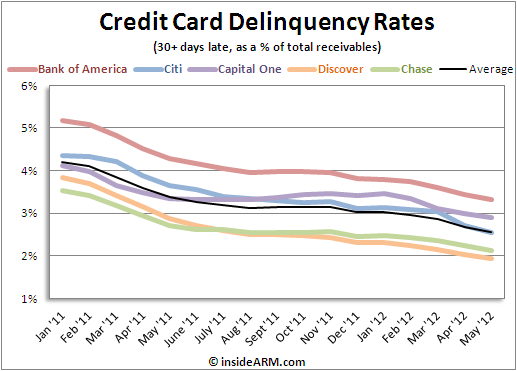

Delinquencies continued to decline in May, with all five banks reporting decreases in their credit card delinquency rates. The average late payment rate in May was 2.56 percent, a fresh low.

Related Content:

- Reducing Credit Card Delinquencies at U.S. Financial Institutions

- The Debt Collection Compliance Handbook

- The Global Debt Buying Report

- Debt Settlement Survey: How Creditors and Collectors Increase Collections

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)