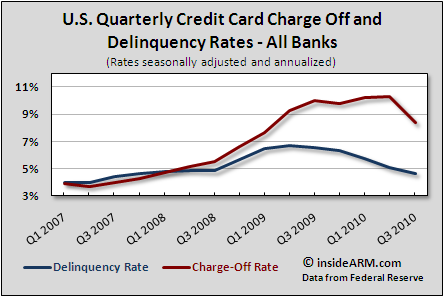

The average charge-off rate for credit card accounts fell nearly 20 percent in the third quarter of 2010 as delinquencies also improved, according to data released last week by the Federal Reserve.

The Fed’s data release showed an average credit card charge-off rate of 8.39 percent at all U.S. banks in the third quarter, down sharply from the 10.37 percent rate reported for the second quarter. It is the lowest average charge-off rate for credit cards since the first quarter of 2009.

U.S. bank report their chargeoff information to the Fed each quarter in their Report of Condition and Income filing. The charge-off numbers reported by the Fed are net of recoveries and are seasonally adjusted.

Credit card delinquencies also improved in the quarter, falling below five percent for the first time in two years. The Fed reported an average credit card delinquency rate of 4.63 percent in the third quarter, down from 5.05 percent in the previous quarter.

The sharp drop in charge-offs marks a shift in the charge-off to delinquency ratio for credit cards. Historically, the average credit card delinquency and charge-off rate have roughly aligned, as banks write off uncollectable balances. But in the financial crisis of the past two years, commercial banks in the U.S. were forced to charge-off massive amounts of bad credit card debt and the two measures diverged.

The Fed’s aggregated data aligns with individual bank filings for September. In that month, none of the major credit card issuers reported a charge off rate above 10 percent for the first time in two years.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)