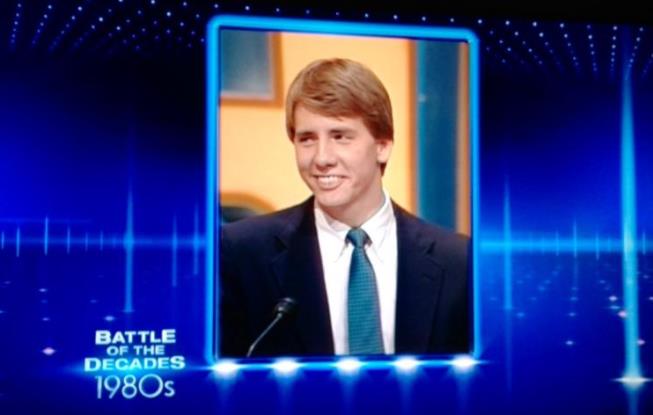

Richard Cordray, Director of the Consumer Financial Protection Bureau (CFPB), came up a little short in his return to TV quiz show Jeopardy!, which aired last night. Cordray was previously an undefeated five-time champion on the show in 1987. The day before, a House Committee chairman sent a letter to his caucus preparing them for floor action on a bill that would restructure the CFPB.

Cordray was revisiting the game show for a “returning champions” week of special match-ups of previous winners. This specific episode was billed as “Battle of the Decades: 1980s.”

In 1987, while clerking for U.S. Supreme Court Justice Anthony Kennedy, Cordray won in five-straight episodes – at the time, the show’s limit – taking home more than $45,000. This time around however, Cordray was not able to keep any of his winnings; as a Presidential appointee, he cannot keep the money nor can he donate it to charity.

But last night he came up a little short against stiff competition, placing second.

His appearance came just a day after U.S. Rep. Jeff Sessions (R-Texas), Chairman of the House Committee on Rules, sent a letter to his colleagues informing them of a possible meeting next week to consider a rule on the amendment process for H.R. 3193 (the “Consumer Financial Protection Safety and Soundness Improvement Act of 2013”). These types of letters generally signal that a bill will come up on the House floor soon.

The bill, which was passed by the House Financial Services Committee in November, would restructure the CFPB and fundamentally change the way the agency operates. It would create a five-member commission to head up the Bureau (rather than one director), make the CFPB a separate agency subject to Congressional appropriations (rather than getting its funding through the Federal Reserve), and give the Financial Stability Oversight Council the ability to overrule CFPB rules with a majority vote.

The bill contains much of the desired changes to the CFPB opponents have been seeking since its creation in 2010.

But even if the bill passes the full House, it faces near-certain death in the Senate and the threat of veto from the President.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)